We acquire the

potential others

abandon .

Buying overlooked venture assets and converting them to default live — for founders, teams, and every stakeholder involved

Every startup believes,

“We’ll be the next unicorn.”

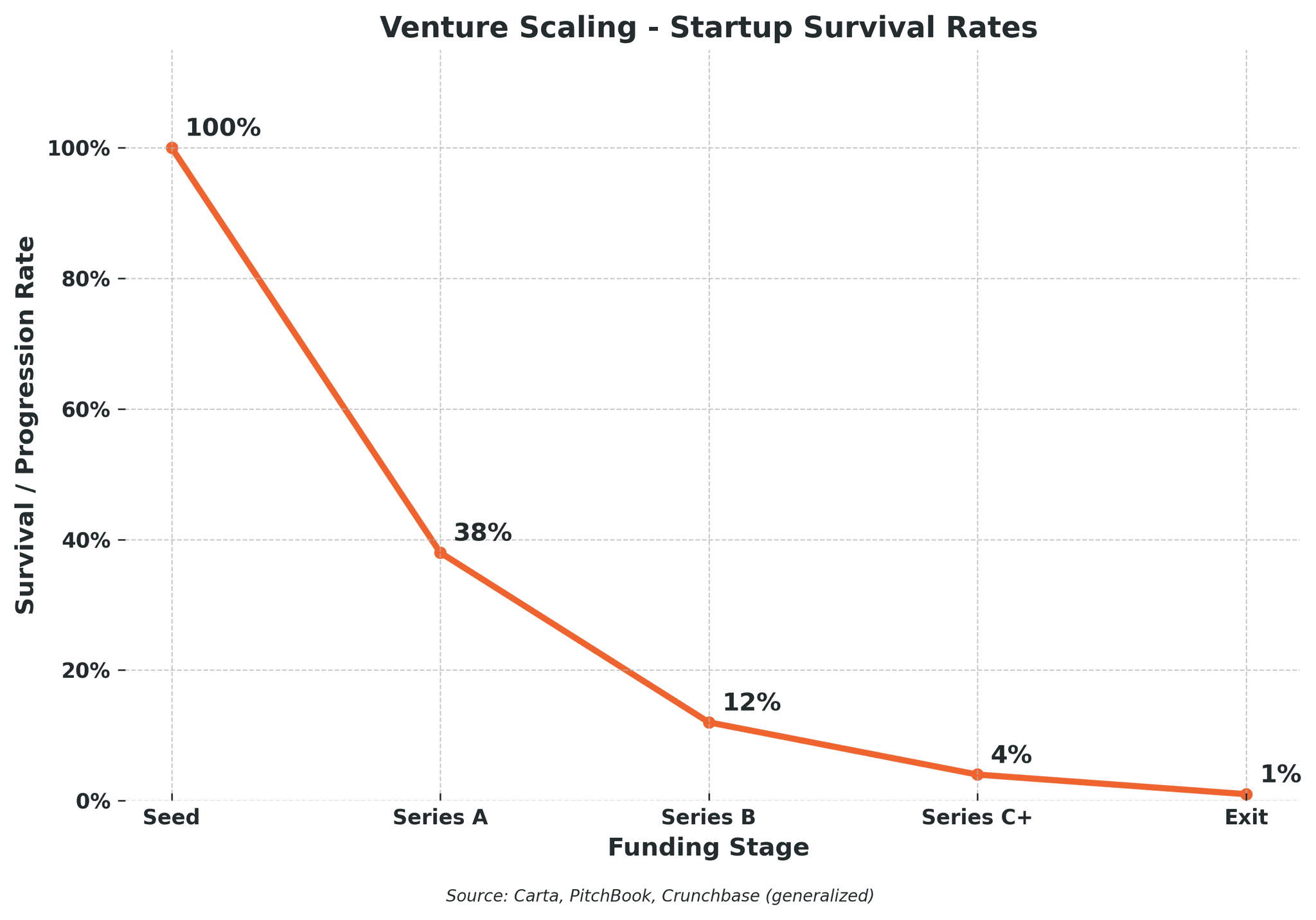

But the harsh reality... fewer than 1% ever make it.

When the belief behind venture scale fades, the unspoken cycle sets in, impossible fundraises, recaps, layoffs and ultimately a shutdown. Laplace offers a different outcome: we acquire the business, restore it to cash-flow positive, and compound profits for long-term growth. With an embedded team of operators stepping in from day one, we cut the burn, reignite growth, and keep the product, brand, and momentum alive - while sharing in the rebound.

Why our model is the best option for distressed startups

- Valuation-led; unrealized gains drive decisions

- Checks written; limited operational support

- Swing-for-the-fences model (unicorn or bust)

- Blitzscaling pressure and runway risk

- Spend at all costs > Sound business decisions

- Founders sacrifice everything, burnout or failure = written off – no inbetween

- We acquire overlooked Seed–Series A with solid fundamentals (even if cash-flow negative)

- Inject capital + execution partners Day 1 (engineering, AI/data, product, GTM)

- 90-day plan to stop burn; target profitability ≈ 12 months

- Founder-friendly: cash at close + rollover equity; team retains upside

- Brand & customer first; long-term hold and compounding cash flow

- All involved parties reap the benefits

- Buyouts often debt-financed; later-stage focus

- Rarely touches Seed–Series A or negative cash flow

- Financial engineering > product & innovation

- Optimizes for resale/IPO timelines (flip your company for $)

- Transactional approach; less emphasis on brand & customers

- Founders easily outed and replaced (if deemed part of plan)

How Laplace Capital Works

Our streamlined process gets you from initial contact to cash-flow positive in 12-18 months

Deal Intake

We evaluate opportunities against Laplace’s eligibility gateways, using a refined scorecard that measures market viability, operational health, and conversion potential. Only the most strategically aligned and recoverable assets move forward.

Deal Approval

We classify each deal based on performance against target thresholds:

- Best-Case targets: Fast-Track to LOI (7–10 days)

- Acceptable targets: Move into next diligence phase

- Below threshold: Fast No

Integration Playbook (Day 1)

Once acquired, we activate a hands-on operator bench of vetted startup experts — specialists in product/tech, brand/GTM, finance/ops, and AI/data — to begin immediate stabilization and conversion.

Conversion Milestone

Our goal: take the business from cash-flow negative to break-even or cash-flow positive within 12–18 months. This is tracked through clearly defined operational and financial KPIs.

Re-Distribution & Compound

Profits are strategically reinvested into sustainable growth while a portion is distributed to the Laplace Capital Treasury — fueling the next acquisition and conversion cycle.

Evergreen Cycle

The process repeats: new acquisitions are evaluated, approved, integrated, and optimized, creating a compounding portfolio of converted, cash-flow-positive companies under the Laplace Capital HoldCo.

Our Target Startup Range

We focus on Seed → Series A, B2B Tech & Tech-Enabled Service startups that faced challenges within the traditional venture scaling model

Cash-flow negative and/or written off by investors

Achieved a form of Product Market Fit (PMF)

Defensible business model with AI-resistant advantages

Proven distribution and/or distribution channel/s

Proven pain-point values in product offering

Low rewrite costs and salvageable operational systems

Frequently Asked Questions

Get answers to the most common questions about working with Laplace Capital and our acquisition process.

Let's Start a Conversation

Ready to transform your startup? We're here to help you navigate the path to success. Reach out and let's discuss how we can partner together.